Thursday, December 24, 2009

What cannot science know... quite a bit

Tuesday, March 3, 2009

There is no business school anymore

What is the definition of Failure?

Wednesday, February 25, 2009

Hubris is my, Middle Name

Monday, January 26, 2009

When Criminal Becomes Legal.

When Criminal Becomes Legal.

Since John Brown, former member of the British Parliament began contributing to the Pittsburgh Tribune Review opinion page I've become an avid reader. His thinking has influenced mine. And I've integrated some of the his ideas with my understanding of this imposed financail crisis.

In a recent conversation I made the statement that this is a real crisis based on imaginary causes. This peaked some ire, and gave me the opportunity I sought to explain my understanding of recent events. Basically I made the case that yes, loose credit and debt laden Americans are responsible for the unwillingness to address inherent problems in our economy (your 70% GDP/consumption stat). And yes, the government did drive the economy into a ditch with financially illiterate rules and regulations that created the subprime crisis and the debasement of the dollar. I'd add that the citizenry's entitlement mentality is a corollary with these factors creating an unsustainable Social Security Scheme, the potential for further disasters in Health Care and a Welfare State that is creating a permanent underclass of dependant wards of the state.

Significantly it is the cooperation of government and industry lining the pockets of those barons of Wall Street and others that encouraged the bubbles of the Internet, Investing, Housing and Commodities. Now I am not opposed to capitalism benefiting those with capital - however the imaginary, over-leveraged, high-margin OPM (other peoples money) had doped those in positions of power. Bernie Maddoff is not entirely an aberration but an exemplar of the times even a symptom of a greater disease. It is this disease of criminally irresponsible plutocratic capitalism that has metastasized. The house of cards is crumbling while Bush and Obama offer the same solutions - Bailouts and Stimulus. Now the risk of failures has been mitigated and the justice of the market pardoned. Instead the burden of failure being on those who took the risks it is being foisted upon the masses - that crucial and useful middle class of capitalism. We will carry the weight of the debts of this country for generations, if not until the global economy's utter ruin. This is criminal in the highest order, yet none of these crimes will be prosecuted because the mafia is making the rules. The foxes are guarding the hen house.

Therefore I ask what do we do when the criminal become legal?

Am I wrong?

Don't we have a major foundational problem that goes much deeper that the $INDU?

Tuesday, January 20, 2009

Open Tread on Innuguration

Wednesday, January 7, 2009

Spengler on Ethics and Economy

By Spengler

"President Roosevelt is magnificently right," John Maynard Keynes wrote of president Franklin Delano Roosevelt's decision to devalue the American dollar in 1933. If any economic policy stance deserves such praise today, it is that of Pope Benedict XVI, whose views on ethics and economics occasioned a flurry of comment last month. Italy's Finance Minister Giulio Tremonti observed, "The prediction that an undisciplined economy would collapse by its own rules can be found" in a 1985 paper (see Market Economy and Ethics, Acton Institute) by then Cardinal Joseph Ratzinger, which Tremonti called "prophetic". I don't know whether it was prophetic, but the future pope was right, and magnificently so.

An unethical economy, he argued, will destroy itself, and economics cannot determine whether any activity is ethical or not. Internet stock valuations, the market delusion of a decade ago, presumed that pornography, gaming, music downloads and shopping would be the driving forces of the future economy. It is easy to ridicule this Alice-in-Wonderland accounting after the fact, just as it is easy to laugh at television advertisements that even today urge Americans to buy homes because their prices double every 10 years (for example this commercial by the National Association of Realtors posted on YouTube). But what should we say of an economy based on consuming as much as one can without troubling to bring children into the world?

Here is what then Cardinal Ratzinger said about it more than 20 years ago:

It is becoming an increasingly obvious fact of economic history that the development of economic systems which concentrate on the common good depends on a determinate ethical system, which in turn can be born and sustained only by strong religious convictions. Conversely, it has also become obvious that the decline of such discipline can actually cause the laws of the market to collapse. An economic policy that is ordered not only to the good of the group - indeed, not only to the common good of a determinate state - but to the common good of the family of man demands a maximum of ethical discipline and thus a maximum of religious strength.

What caused the laws of the market to collapse in 2008? In another location (see The monster and the sausages, Asia Times Online, May 20, 2008), I argued that the bulge of workers in the US and Europe approaching retirement age is the ultimate cause of the financial crisis. Too much capital chased too few investment opportunities, and the financial industry met the demand by selling sow's ears with the credit rating of silk purses.

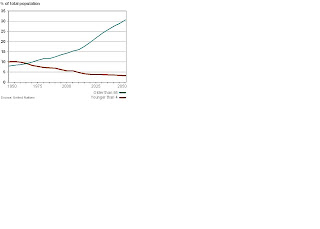

Underlying the crisis is the Western world's repudiation of life, through a hedonism that puts consumption or "self-realization" ahead of child-rearing. The developed world is shifting from a demographic profile in which the very young (children four years and under) outnumbered the elderly (65 and older), to a profile with 10 times as many retirees as children aged four or younger. Economics simply never has had to confront a situation in which the next generation simply failed turn up.

Percentage of developed nations' population younger

than four years and older than 65 years

It is not just the professionals who were ethically challenged. Bankers who insisted on dancing until the music stopped, as Citigroup's former chairman Chuck Prince wisecracked just before his 2007 dismissal, deserve the rage of the public. So do the analysts working for Moody's Investor Services who acknowledged in messages made public by Congressional investigators that "we sold our soul to the devil for revenue". The moral rot reaches into most of the families in the developed world.

In the cited paper, Cardinal Ratzinger picked a bone with the determinism of the "free market" economic model:

Following the tradition inaugurated by Adam Smith, this position holds that the market is incompatible with ethics because voluntary "moral" actions contradict market rules and drive the moralizing entrepreneur out of the game. For a long time, then, business ethics rang like hollow metal because the economy was held to work on efficiency and not on morality. The market's inner logic should free us precisely from the necessity of having to depend on the morality of its participants. The true play of market laws best guarantees progress and even distributive justice ...

This determinism, in which man is completely controlled by the binding laws of the market while believing he acts in freedom from them, includes yet another and perhaps even more astounding presupposition, namely, that the natural laws of the market are in essence good (if I may be permitted so to speak) and necessarily work for the good, whatever may be true of the morality of individuals.

There is something profoundly disingenuous about the pure free-market model, to which an even stronger objection might be raised, namely that it cannot possibly exist. The market does not spring into being like warriors from the dragon's teeth sown by Cadmus. Markets are part of society, and if society passes the demographic point of no return, the market will die along with all other social institutions.

There is an obvious, glaring flaw in the deterministic model: even if we assume that no one ever cheated, lied, or stole, the market can't determine who enters it and who leaves it. First of all, these depend on birth and death, and secondly on law and custom. For example: who is allowed to take deposits from the public, and make loans? In the pure free-market model, every deposit-taking bank would make loans in its own currency, and the public would value a JP Morgan dollar differently from a Bank of America dollar or a Citigroup dollar, not to mention a dollar from the late and unlamented Washington Mutual.

Until 1863, that is how American banks operated. The late Milton Friedman, a consistent if sometimes quixotic advocate of free markets, proposed a return to this chaos. If the public treasury guarantees bank deposits, he observed, the market no longer is free.

In Congressional testimony this autumn, former Federal Reserve chairman Alan Greenspan notoriously admitted that his free-market philosophy was inadequate. Yet nothing that occurred under Greenspan's tenure had to do with freedom. Banks that enjoyed a monopoly due to their federal charters were permitted to transfer assets away from their balance sheets to other entities, allowing them to use much less capital to support assets than in the past. Even worse, the Federal Reserve allowed larger and more sophisticated banks to put less capital against assets that bore a high rating from Moody's and Standard & Poor's - the agencies that later owned up to having sold their souls to the devil for revenues.

Greenspan, it turns out, presided over a bubble manufactured by the most-regulated private companies in the world, the large commercial banks, who operate with the implicit guarantee of the US Treasury. When the banks got into a hole, the Treasury guarantee became explicit, and floated the banks out of the whole with several trillions of dollars of actual and prospective taxpayer money. Private interests appropriate a small but noticeable fraction of America's wealth, emulating in a very small way the behavior of private interests in Argentina, which typically steal all the national wealth as well as whatever they can borrow from foreigners.

The future pope made two parallel points: first, that morality cannot be effective without competent economics, and secondly, that economics cannot dispense with morality by trusting to the supposedly automatic workings of the marketplace:

A morality that believes itself able to dispense with the technical knowledge of economic laws is not morality but moralizing. As such it is the antithesis of morality. A scientific approach that believes itself capable of managing without an ethos misunderstands the reality of man. Therefore it is not scientific. Today we need a maximum of specialized economic understanding, but also a maximum of ethos so that specialized economic understanding may enter the service of the right goals. Only in this way will its knowledge be both politically practicable and socially tolerable.

A clearer way to make these distinctions, perhaps, is to observe that the market mechanism has a negative but not a positive function. The market cannot decide what innovations or practices are beneficial to society. It can only punish incompetence and inefficiency. "Creative destruction", in the famous phrase of the Austrian economist Joseph Schumpeter, refers to Goethe's Mephistopheles, who tries to do evil but ends up doing good instead. Without the devilish work of destruction that kills off incompetence, established monopolies would choke off innovation.

Nothing in the market mechanism, however, can distinguish between pornography and art, medicine and recreational drugs, development and suburban sprawl, or, for that matter, family formation and addictive consumption. The modern marketplace arose during the 16th and 17th centuries through demand for silk, spices, rum and tobacco, and destroyed most of the population of South America and perhaps a third of the population of West Africa. In the process, the West learned to form joint-stock companies, write insurance, trade options, and establish central banks. All of these contributed mightily to its economic development later, despite their checkered origins. If moral rot has taken hold of a society, the market mechanism will take it to hell faster and more efficiently than any of the alternatives.

There is an even greater flaw in the theory of the free market, perhaps, and that is in the assertion that the market can form adequate expectations about the future profitability of firms and make proper judgments about allocation of capital. How do we explain away the misallocation of capital to Internet stocks during the late 1990s and to homes in the United States (and elsewhere) during the ensuing years?

The world simply is too uncertain for the market to look more than a year or two over the horizon. Technological and social change occurs in unexpected and dramatic ways, frustrating the best guesses of the cleverest entrepreneurs, not to mention the stodgy decisions of central planners. The market cannot form accurate long-term expectations; at best it can imagine future outcomes. The quality of its imagination in this case depends on cultural factors that transcend economic judgment.

Americans spent the 1990s in a fantasy world, where technological change supposedly would transform the human condition, taking as their intellectual guide science-fiction writers like William Gibson. There was nothing wrong with the market mechanism as such; what went haywire was the childish imaginings of the American public.

The future pope's 1985 paper insists that it is mere moralizing, not morality, to dismiss what economics has learned about the market mechanism. But economics cannot find a remedy for the imagination of an evil heart, or a foolish one, for that matter. Ethics founded on religion are the precondition for long-term economic success, if for no other reason than economies depend on family formation. If the present economic crisis helps the West to reflect on its moral weakness, the cost well may be worth it.

(Copyright 2008 Asia Times Online (Holdings) Ltd. All rights reserved. Please contact us about sales, syndication and republishing.)